Online Banking

Routing Number: 291274085

We will never ask for your login information, do not give it out to anyone.

[su_row]

[su_column size=”1/2″ center=”yes”]

Dear Members,

2019 was an incredible year for NorthRidge Community Credit Union! The credit union remains healthy, vibrant, and growing. This continual positive momentum is a testament to the amazing members and hard work the NorthRidge team has put forward. We know that our success comes from you, our members, and you have shown us that our focus on the credit union motto of “people helping people” is an important one. The team at NorthRidge works to help every member find the right mix products and services that best fit them by listening to and trying to understand everyone’s unique story.

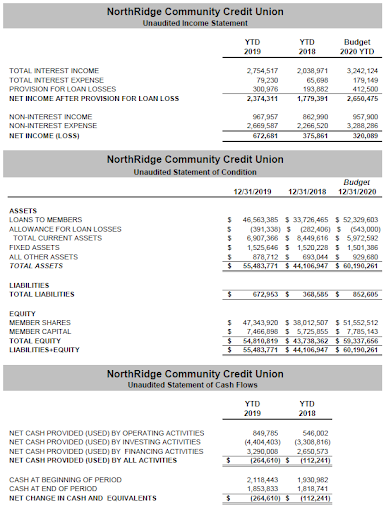

Financials and Other Milestones

In terms of financial stability, NorthRidge experienced very strong asset growth of 26%, moving from $44 million in assets in 2018 to $55 million in assets at the end of 2019. This growth is somewhat exaggerated by the merger at that start of 2019, however, the overall growth excluding that was still very strong.

Lending during 2019 was stronger than ever. NorthRidge was able to make 2,059 loans to members with a total amount of $25 million! These dollars went directly back into our communities helping families buy homes, purchase vehicles, improve their businesses or just make everyday life a little easier. With this strong lending, our entire loan portfolio grew from $34 million in 2018 to $47 million at the end of 2019.

The merger data integration was completed in March 2019. This integration brought the Hibbing office into alignment with the other four offices, and a more seamless experience to the Hibbing area members.

Respectfully Submitted,

Lori Schulze, Board Chair

Nicholas Mathiowetz, President/CEO

[/su_column]

[su_column size=”1/2″ center=”no” class=””]

We review financial records for completeness and accuracy; check to see that internal controls, policies and procedures are maintained and followed; make certain appropriate safeguards are in place to protect credit union assets; and ensure that Board and Management continue to serve the best interests of NorthRidge Community Credit Union and its members while maintaining strict adherence to federal and state regulations. Annually, we select an independent auditor to conduct an Agreed Upon Procedures audit. In 2019, we selected the Minnesota Credit Union Network to perform this important audit. After completion, we review the audit to make certain all recommendations have been implemented.

For 2019, I am pleased to report that the Board of Directors and Management have been excellent stewards of the credit union and your assets.

Respectively submitted,

Connor Michels, Supervisory Committee Chair

[/su_column]

[su_column size=”1/3″ center=”no” class=””]

[/su_column]

[/su_column]

[/su_row]