Women in Credit Unions Today

Earlier this week, we wrote about the historical female figures that shaped credit union history. But, importantly, there are still amazing women leaders in the credit union movement today. A study conducted by Credit Union National Association, or CUNA, (now known as America’s Credit Unions) found that over half (51%) of credit union CEOs are women. And generally speaking, about 60% of all credit union employees are women. For us at NorthRidge, that percentage is closer to 90%!

Gigi Hyland

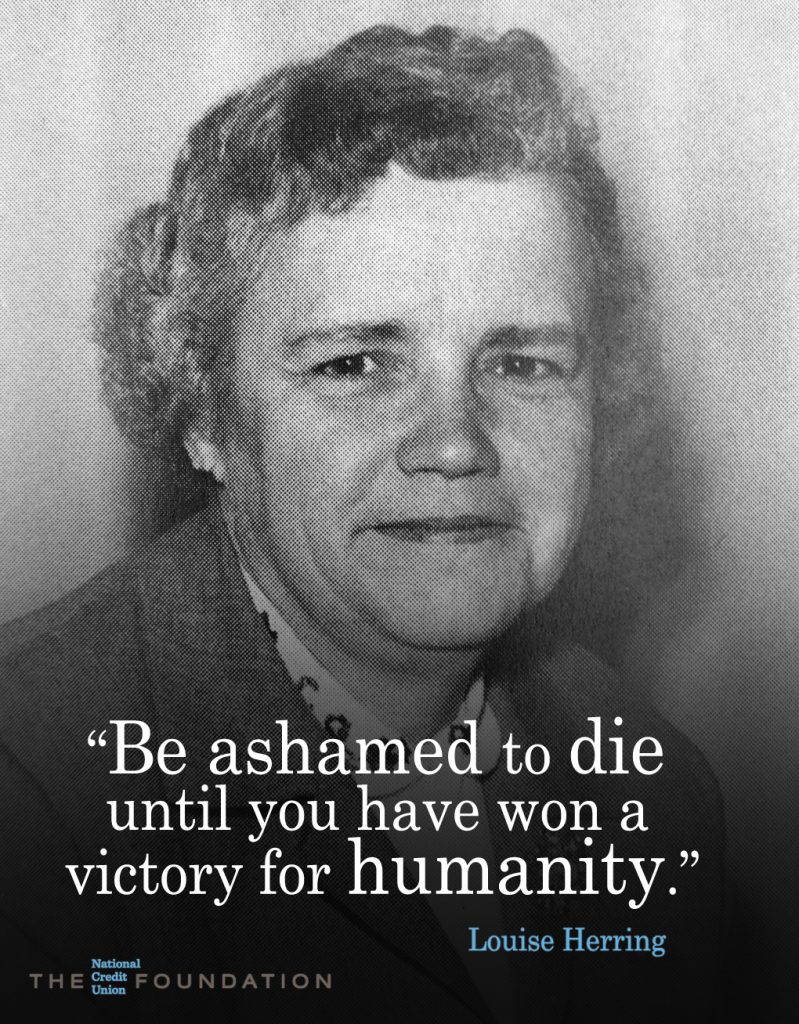

A particularly influential credit union leader today is Gigi Hyland, the Executive Director of the National Credit Union Foundation. From Gigi’s bio: “The Foundation is the philanthropic and social responsibility leader of the credit union movement in the US; they raise funds, make grants, manage programs, and provide education to empower consumers to achieve financial freedom through credit unions.” TLDR; the Foundation is the heart and soul of the credit union philosophy: people helping people.

Before joining the Foundation, Ms. Hyland was a board member of the NCUA (National Credit Union Administration). The NCUA insures member deposits at credit unions and is the governing body for credit union regulation. While there, Ms. Hyland led the development of many new programs and initiatives for the benefit of credit unions and consumers.

Prior to her board presence with NCUA, Ms. Hyland spent 14 years serving the credit union movement as an executive, attorney, and advocate.

Authoring this blog is Ashley Kjenaas, Marketing Coordinator at NorthRidge Credit Union. I had the honor of meeting Gigi Hyland. It was October 2023, and I was in Madison, WI at Credit Union Development Educator (CUDE) training that is provided by the National Credit Union Foundation. At the CUDE graduation ceremony, Gigi watched our presentations (talk about intimidating!) and when she spoke after, she said something that will forever be in my heart, “We are not just a credit union movement, we are a world peace movement.”

That is who we are, and that is our mission. And we have Gigi Hyland as an incredible leader to move us forward.

Recent Comments