Online Banking

Routing Number: 291274085

We will never ask for your login information, do not give it out to anyone.

Credit scores are confusing numbers. Generally, people assume they have this magic number (their credit score) that determines their eligibility for getting loans, acquiring housing, etc. While there is some very marginal truth to that, your credit score is made up of more than one number. And those numbers are made up by multiple data sources and contain many different variables. Your credit score can change month by month, and sometimes those changes can even be drastic.

There are 3 main credit bureaus: Equifax, Experian, and TransUnion. They collect information about you and how you’ve managed your credit. That information is used to create your credit score reports. Your score is based on those reports.

In order to get this data about you, your creditors, debt collectors, and credit applications report information about you to the bureaus. But creditors are not required to report to all three bureaus (or any at all, for that matter). This is why your scores can be different from each bureau.

There are several types of credit scores available, but the two most common are VantageScore and FICO. VantageScore was created by the three credit bureaus together as a competitor to the FICO score. Both can offer creditors different information from one another. Creditors can also choose from different FICO and VantageScore scoring models to review your credit score.

Scoring models give different levels of importance to items in your credit reports. Some models give more importance to certain factors such as auto payments, or mortgage payments. Again, this is why your score can look different from one model to the next.

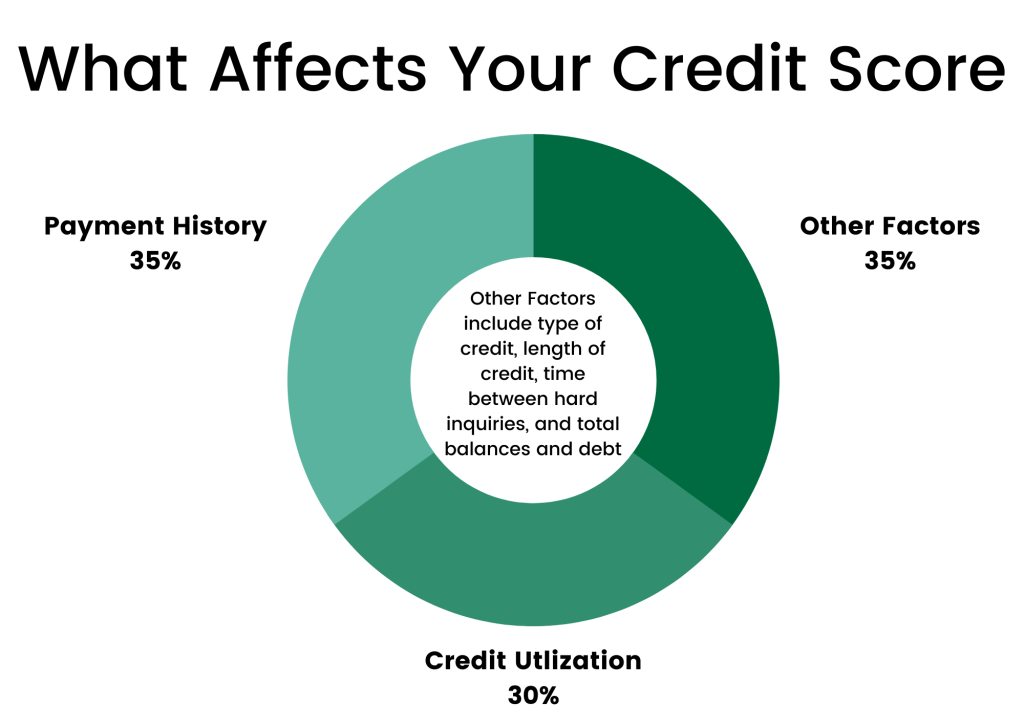

If you are after a high credit score, there are some big-ticket items you can control. Payment history and credit utilization make up more than half of your score, so it is very important to pay close attention to them.

Payment history is the most important factor across the board when it comes to your credit score. Make your payments on time, all the time. Good practices are to set up automatic payments for as many of your bills as you can or set up payment reminders. Sometimes creditors can move your due dates to better times of the month for you, take advantage of that!

Credit utilization is the second most influential factor in your credit score. This is the amount of your available credit that you use. For example, say you have just one credit card with a $10,000 limit and you never carry a balance. Good right? Actually, it’s better for your credit to USE it! Use your credit card, then pay it off. However, keep your balances below 30% of what you have available (with a $10,000 limit you would want to keep your balance below $3,000).

Other factors include length of credit, your credit mix, how long it’s been since you’ve applied for new credit, and your total balances and debt. Longer credit is healthy for your score, so keep older accounts open unless you really need to close them. Variety of credit is also healthy for your score, a mix of mortgage, auto, and credit card accounts (that you pay on time!) would be a great combination. Finally, too many inquiries (shopping for credit) can have a negative impact on your credit score. A good rule of thumb is to only look for credit when you need it and try to limit these inquiries to 2-3 times a year.

Take a look at your current credit situation. Sometimes debt consolidation is a good start to get your finances back on track. If you’re curious about a debt consolidation loan, start by visiting Loans, or give us a call at 877-672-2848!

We all know July as our month to celebrate America’s independence from Great Britain. But did you know that most signers did not sign the Declaration of Independence until August 2nd of that year (John Hancock was the only one to sign it on July 4th, 1776!)? The Declaration of Independence was not delivered to Great Britain until November 1776! Enjoy your weekend of celebrations!