Online Banking

Routing Number: 291274085

We will never ask for your login information, do not give it out to anyone.

Unfortunately, fraud and scams are unavoidable in today’s world (not unpreventable, though). There are varying types of serious fraud and varying types of scams. Sometimes it can feel like someone is always trying to scam you. Scam text messages are as common as scammers calling you, and scam emails are still prevalent. A friendly reminder is to ALWAYS verify you know the sender, and NEVER give personal information about yourself or others out via email, text, or even over the phone unless you called a verified phone number.

If you are concerned about possible fraud on your NorthRidge account, please contact our fraud department as soon as possible: 1-833-285-1749

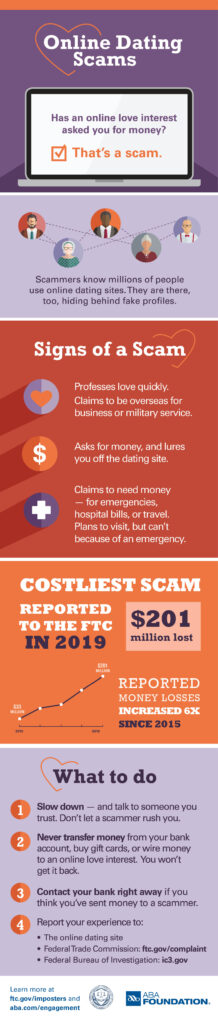

The best way to prevent scams is by being alert and aware. Scams that are becoming more popular involve dating apps and online dating. Scammers get victims to chat with them after “matching” on an app. They will send photos and other anecdotes to convince the victim they are who they say they are. Then they eventually convince the victim to send them money. Sometimes this happens repeatedly with the same scammer and victim, and the victim sends money regularly, sometimes over several months, before finding out they’ve been scammed. Be alert, be vigilant, and never send money or personal information to anyone you’ve never met in person.

Scam text messages are becoming more popular, and sometimes they are very convincing. If you receive a text from a phone number that you do not recognize, claiming to be someone you know, contact that person via the contact information you already have for them. Do not reply to the unknown number.

Email scams are also getting more convincing. Do not click links in emails you were not expecting, and do not reply. Confirm the legitimacy by doing your own quick web search on the supposed sender. Also, think about where you may have recently left your email address (maybe on a new website you found and wanted to get a discount code, etc.).

Fraudulent checks are one of the most common frauds committed. They are so widespread with so many different types that it’s impossible to determine just how many people are affected. Protect yourself by learning how to detect fraudulent checks. Follow these steps to detect some of the most common signs of fraudulent checks:

By being suspicious of things that just “feel” a little off, you can protect yourself from falling victim to frauds and scams. You cannot be over-cautious when it comes to YOUR money and YOUR financial wellness!