Online Banking

Routing Number: 291274085

We will never ask for your login information, do not give it out to anyone.

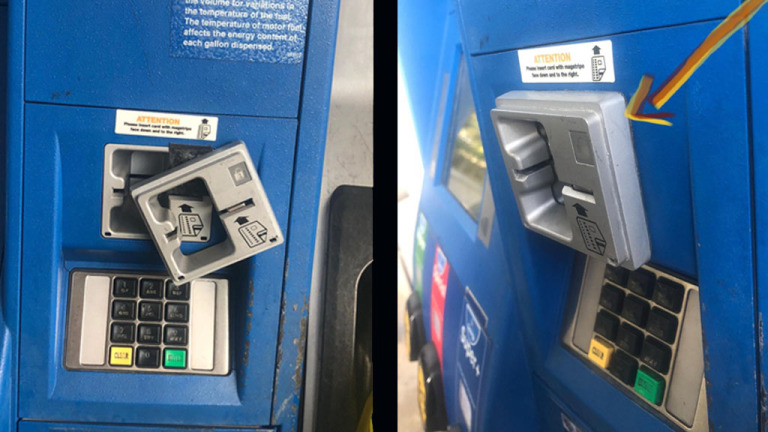

There is recent news about card skimming fraud happening in St. Louis County areas. We want to remind our members and community to be careful where you use your card and always do a scan before inserting your card into gas pumps, ATMs, vending machines, etc.

Card skimmers collect data from your debit and credit cards’ magnetic strip, allowing scammers to access your accounts and other personal information.

Skimmers read the magnetic strip on a card when it is swiped at a point-of-sale machine or ATM. Skimmers can also record PIN entries.

A skimming device is not obvious at first glance. Devices installed on the outside of card reading machines can look like they belong there. Some devices are attached inside the card slot, making it even harder to detect. The skimming device reads and collects your card information.

If you notice a skimming device is present after you inserted your card, you should call local authorities and your financial institution immediately. Unfortunately, most people never notice the device until it’s too late.

Always stay aware of your surroundings and vigilantly protect your payment information! Being extra cautious could save you from falling victim of identity theft.

NorthRidge has contactless cards!