A new year could bring new scams.

Scammers and fraudsters are constantly looking for new ways to get money from you. It is up to you to protect yourself from falling victim to a scam. Oftentimes scammers are so sophisticated that they can trick you into willingly giving them cash or worse, your account information. If this happens, it’s usually impossible to get your money back.

This year, we are going to take some extra time to chat about scams, and how to protect yourself from becoming a victim. Because these topics are so important, we are including a chance to win one $20 Visa gift card for every blog posted with the topics of fraud and scams. Take the one-question quiz at the end of each blog post about fraud and scams, answer correctly, and you’ll be entered for a chance to win!

Scams in 2024: Artificial Intelligence

Scammers might use new technology, like AI, to add new twists to scams that have worked in the past.

Today, we’re going to talk about AI powered scams. Artificial intelligence can easily create videos, photos, and voices that look and sound like celebrities, your employer, or even your relatives. You are tricked to believe that you are speaking to someone you know and trust, but you are not.

These impersonation scams or deepfake scams are on the rise and can be extremely realistic.

Grandparent Scam

A common AI scam is when a scammer calls someone pretending to be a grandchild (or other type of relative). AI can collect audio data (from social media or other sources) to clone your relative’s voice and sound like them when they speak to you. They will mention a stressful or urgent situation they are in and request money. They may also request you keep it a secret from the family so they will not be embarrassed (affecting your emotions by making you feel special that this “relative” reached out to you, but to also avoid getting caught in their scam). Then, they request a wire transfer of money or that you buy gift cards and give them the information.

To avoid scams like this, confirm the identity of this person. Ask them questions that only your relative would know. Stop the conversation and reach out to that relative by the contact information you have for them. You could also reach out to another relative that would know the situation if it was real.

Typical Scam Elements

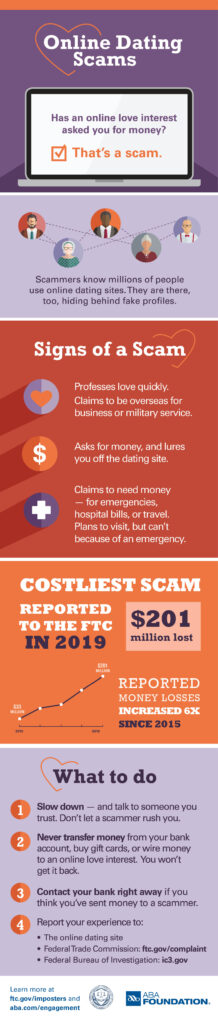

Learn to recognize a scam right away by remembering these scam hallmarks:

- Urgency and pressure to act fast.

- Requests to keep it a secret or keep it between the two of you.

- Using scare tactics.

- Requests for money, commonly in cash, wire transfers, gift cards, cryptocurrency, or other means that is difficult to track or recover.

- Specific instructions on how to complete the transaction.

- Offers that sound too good to be true.

Stay Vigilant

It is unfortunate that this is the world we live in, but you must remain constantly vigilant and alert when it comes to protecting your money, your accounts, and your identity.

NorthRidge will never ask you for your login information. Do not give your online banking login information to anyone, not even someone claiming to be from your financial institution.

When in doubt, hang up, do not text back, and/or delete suspicious emails.

Recent Comments